The Budget 2007 announcement on Friday will hopefully be the light at the end of the tunnel for Malaysian politics. No one should dispute the fact that the run-up to this year’s Merdeka celebrations had been particularly tumultuous.

Soured relations between ex-prime minister Tun Dr Mahathir Mohammad and current premier Abdullah Badawi gained embarrassing national headliners as well as international attention.

Rifts within Barisan Nasional, the ruling coalition, were also cause for concern. Khairy Jamaluddin, Deputy Chairman of Umno Youth caused a public furore when he reportedly suggested that non-Malays would take advantage of a weak Umno –one of the three founding member of the coalition –if members were divided.

Penang’s Chief Minister Dr Koh Tsu Koon came under fire as well when certain Umno division leaders accused him of neglecting the development of Malays on the island.

Wong Chun Wai of The Star praised the new budget for boosting public morale which had taken a bashing in recent months over racial issues. “There will surely be a chorus of approval for Datuk Seri Abdullah Ahmad Badawi’s many decisions in the Budget, which has emphasized on needs rather than race,” he wrote.

Under the new budget plan, examination fees for UPSR, PMR, SPM and STPM are to be waived. Students whose family income amounts to less than RM1,500 will be awarded scholarships if they score 10A1s in the SPM exams.

About 542,000 pensioners also stand to benefit from a one-off payment of up to RM400. Apart from that, civil servants earning less than RM750 a month would receive a two month bonus.

All this will surely ease the burden on lower income families who have been the hardest hit by higher living costs and fuel prices.

The tax relief of RM3,000 for computer purchases and RM1,000 for books will mainly benefit those in higher income brackets. To illustrate the obvious, those living on a RM24,000 annual income are less likely to buy a new computer compared to those who earn RM100,000 a year. A new PC at RM4,000 would account for 17% of income earned by the former but for the latter the proportion is only 4%.

The government’s move to lower the corporate tax rate came as a pleasant surprise to many as Abdullah had refrained from reducing taxes in his previous two budgets in efforts to keep the budget deficit in check. The prime minister is counting on this reduction to spur economic growth.

The corporate tax rate will be cut to 27% in 2007 and 26% the following year. This is the first time in nine years that a reduction has taken place –the rate was previously lowered back in 1998 from 30% to the current 28%.

While the 2007 budget has been a boon to many, it should be noted that a one percentage point cut in corporate tax will imply a loss in government revenue of RM1 billion a year. While the government intends to balance the budget in the long run, this time the government is incurring a deficit of 3.4% of GDP.

To justify the government’s budget deficit it is important that meritocracy and efficiency are upheld as best practices in the country. Decision-making should at all times be based on merit and never on political connections.

Further development of Information and Communication Technology (ICT) was one government-implemented move in efforts to add value to the domestic economy. Mimos Bhd, a research and development organisation in this area will receive RM162 million under the new budget. Financial weekly The Edge has reported that “little has come out” of the RM2 billion that has been invested in it.

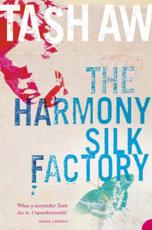

Tash Aw, Fiction

Tash Aw, Fiction